what to look for in a venture capital company

A Quick Guide to Startup Funding

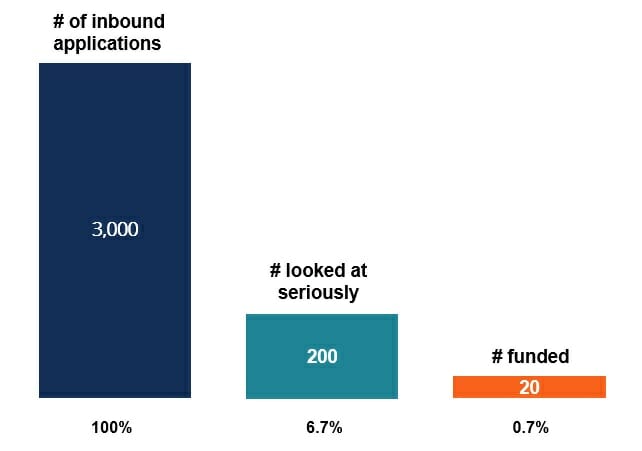

Raising money from a Venture Uppercase (VC) house is extremely challenging. The odds of receiving an equity cheque from Andreessen Horowitz is only 0.7% (encounter below), and the chances of your startup being successful after that are simply 8%. Combined, that'southward a 0.05% or one in 2000 success rate.

Epitome data source. Notation: graph is non to scale.

So, how tin you increment your odds of building a company that will succeed?

This guide highlights what the top venture capital firms look for in a business concern idea and in a founder.

The Odds of Being Funded by a Acme VC

The odds of being funded past Andreessen Horowitz are approximately 0.vii%.

Marc Andreessen (founding partner of Venture Upper-case letter firm Andreessen Horowitz) recently provided an interesting breakup of the odds of a startup receiving funding from his firm in an interview at Stanford Graduate Business organization School.

In the interview, Andreessen explains that there are approximately four,000 startups a yr that are seeking to raise venture majuscule funding.

Of the iv,000 startups looking for funding, they expect at about 3,000 per year, more often than not coming from inbound interest. That number breaks downwards to looking at approximately 12 opportunities per twenty-four hours (l weeks per year, five days per week).

Of the 3,000 they screen, they look at 200 very seriously.

In the finish, they invest in about 20 startups each year (0.seven%).

The Odds of Succeeding for a Startup Funded by a Summit VC

Andreessen goes on to explicate that, from an aggregate perspective, the top VCs fund approximately 200 startups per year.

Since there are 4,000 companies looking for funding, that translates to odds of five.0%.

Of the 200 that are funded by top VCs, 15 of those startups will generate nearly all of the economic return. The rest volition either become to zero or limp along without generating much render.

Therefore, even the elevation VCs tank over half their deals. Thus, they have to exist very careful and are somewhat paranoid about being wrong.

The Total Odds of Success Are 1 in 2,000

If the odds of being funded are 0.7%, and the odds of a funded company succeeding are eight%, the total odds of success are 0.05% (one in 2,000).

What Do VCs Expect for in a Startup?

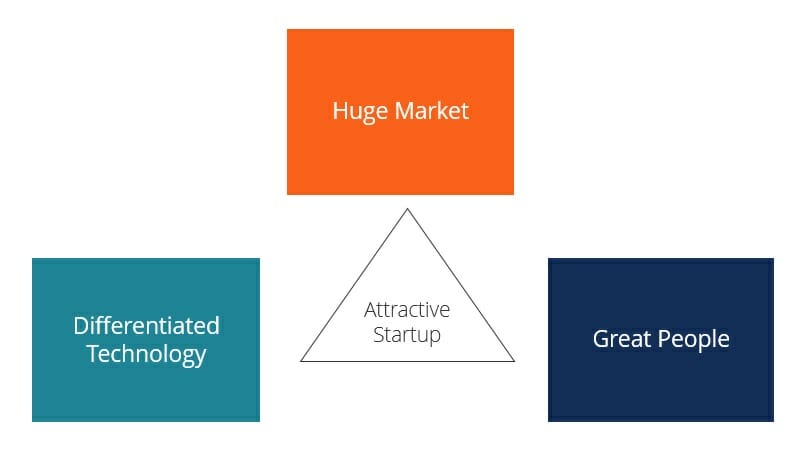

When a sponsor like Andreessen considers funding a startup there are a few main things they expect for.

The three qualities they look for in a startup are:

- Huge market place

- Differentiating applied science

- Incredible people

These criteria are quite logical. If the market is too small, it doesn't matter how great the product or service is, it just won't have a large bear upon. If the technology is also similar to other competitors, then the odds of breaking away from the pack are low. Finally, without incredible people, neither of the other 2 criteria matters.

What Does a Top VC Look for in a Founder?

Of the above three criteria (market, engineering, people) most venture capital firms will say the decision largely comes downwards to people, as opinions on markets and technology are extremely challenging to get right, and are not necessarily that relevant.

In terms of people, the two most important traits are:

- Backbone – not giving up in the confront of adversity; adamant to succeed; can learn from mistakes

- Genius – ideas, manner of thinking; harder to force yourself to do/more intrinsic

Of those two traits, one tin be learned (through conditioning), but the other cannot.

We are all born with a sure backbone quotient, but that figure can be significantly enhanced through life experience, conditioning, and preparation.

Genius, on the other manus, is very difficult to develop. Intelligence can be improved through reading, continuous learning, etc., but it may not raise your chance of success.

That's not to say genius is more of import than courage – not at all. Having willpower and not stopping at any obstacle is essential.

What Makes a Skilful Pitch vs. a Bad Pitch?

Good pitches

A skilful pitch, according to Andresseen, tin can walk yous through the "thought maze" of how they got from their original concept to a commercial idea that volition actually piece of work. There is only a short window of fourth dimension to present to an investment committee, and then the story has to be very succinct, logical, and compelling.

Bad pitches

A bad pitch substantially lacks the qualities of the adept pitch list higher up.

Specifically, a bad pitch may have the following traits:

- Thought maze is not well explained (gets lost in the maze)

- Small market, ordinary technology, ordinary people

- Founder doesn't stick to his/her position when challenged on information technology

- A "me too" strategy (due east.g., it'south like Snapchat, for cats)

Helpful Resources For Startups and Founders

If you lot're hoping to raise money from a pinnacle venture majuscule firm, then you've definitely got your work cutting out for you! To help you prepare for your pitch we've got plenty of tools and resources to support you. Relevant resources include:

- Private visitor valuation guide

- DCF modeling techniques

- Financial modeling templates

- Excel courses

Source: https://corporatefinanceinstitute.com/resources/knowledge/other/how-vcs-look-at-startups-and-founders/

Post a Comment for "what to look for in a venture capital company"